Inflation and the Economy: What it Means for You

An Interview with Melissa Lee

December 6, 2022

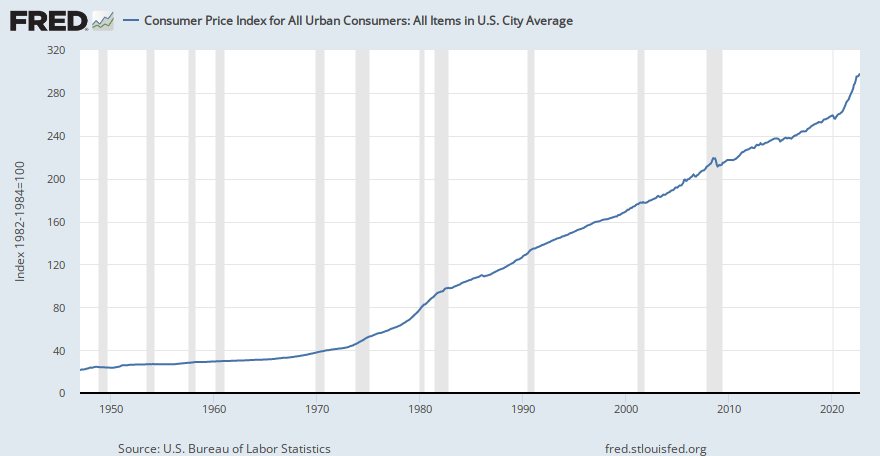

The US economy has seen major turmoil over the last year. Inflation is at all-time highs and interest rates are going up, impacting average Americans heavily. The Federal Reserve has been trying to dampen this inflation through a variety of measures.

But first, what is the federal reserve and what does it do? The Fed is independent of the federal government and works on regulating cash flow. They use a multitude of different tactics to achieve their two main goals of maximum employment and stable prices.

We talked to Melissa Lee about the impacts of the Fed on the economy. She has been an anchor for CNBC for the last twenty years and hosts a show from 5-6 PM called Fast Money. She has worked in financial journalism for the last thirty years as an incredibly well-versed reporter and financial journalist, and she had a lot to say about the current state of the market.

She first started by discussing the interest rates and inflation, saying, “I think what the Fed is going to do is, it’s a little bit of a wildcard at this point. It has come a long way in terms of the number and the amount that it has hiked this year and it has had an unprecedented trajectory of rate hikes.”

This rapid progression of rate hikes will have both short and longer-lasting effects. Short-term effects have already been felt and have come in the form of mortgage rates increasing and debt becoming more expensive. Mortgage rates have reached as high as 7% after being as low as 5.5% in early August.

Melissa added that it could be a year until we feel the full effects of the recent rate hikes, saying, “How it affects the unemployment picture, that’s going to take much longer.” She saw non-farm payroll, or the unemployment metric, going towards 5% in the long run if all goes to plan. Unemployment is currently at 3.7%, so she sees it rising another 2% or so in the long term.

As for the global picture, Melissa alluded to the idea that we have to be paying more attention to the global economy. “That’s the one part of the puzzle the Fed doesn’t have control over. The Fed can do all sorts of things with our own monetary policy, but when it comes to unsnarling the supply chain issue, the Fed has no control over it.”

When asked about the current protests in China over COVID protocol, she said that if the shutdown lasts, it is going to cause a locking of the entire country, and global companies like Nike and Lululemon are going to be heavily impacted.

With all this in mind, what should the average American be looking out for? Well, Melissa Lee said, “I think that you have to think about debt really carefully because money is not free anymore. You have to think about how much you are paying for the privilege of borrowing money.” This means that unnecessary spending should be cut down and, during this holiday season, Americans should be looking for cheaper alternatives.

However, the long term is still extremely positive. “Think about investing for the long-term. Even though it might be a tumultuous time in the market, don’t give up investing now as compounding is your best friend. The sooner you put a dollar in the stock market today, the more it will be worth when you need to pull it out.”

As a final question, we asked her if there is some “north star” that consumers should be looking toward. She responded by saying that there isn’t just one indicator but more of a “quilt work of indicators.” The main one to look out for, however, is the CPI, or consumer price index. The ultimate goal is for the CPI to continue coming down toward the Federal Reserve’s goal of 2%. However, overall there are a variety of factors that are going to come into play.