Are Streaming Services on the Decline?

With Netflix reporting a loss of more than $50 billion, what does it mean for other streaming services and the future of streaming online?

May 19, 2022

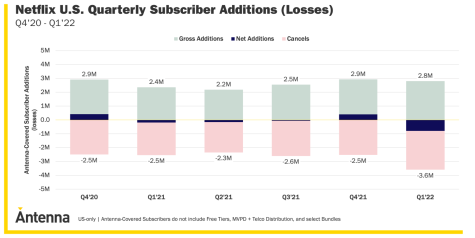

It is clear that Netflix have established themselves as a global superpower in the world of digital streaming, reporting a revenue growth of $1.36 billion to $25 billion in a matter of 12 years and housing nearly 220 million subscribers as of 2022. However, gods can bleed too. Netflix announced earlier this April on a loss of nearly 200,000 subscribers in its first quarter, closing down more than 35% of its shares on its disastrous performance. With Netflix being a frontrunner in the streaming industry, what does this mean for other streaming services? Are declining numbers just a reflection of Covid’s waning effects or is there something more to the business model of these platforms?

Using Netflix as a model system for other streaming services, Netflix generates money through two primary sources of revenue: membership fees and DVD rentals, although uncommon today. A common misconception with the business model of Netflix is that they generate revenue through people simply watching shows or movies. Netflix’s business model is rather one based on the growth of subscribers. The arrival of new movies or tv shows aren’t geared towards people that are already subscribed, rather towards people that aren’t subscribed. This business model is also connected as to why certain popular shows get canceled, despite being popular, as they don’t generate new subscribers.

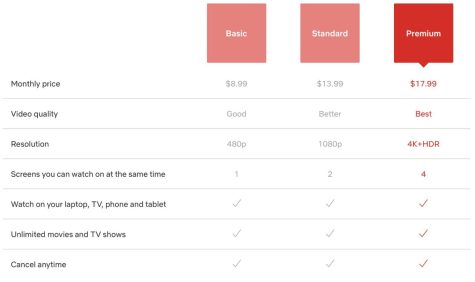

Netflix offers multiple options in streaming plans. A basic plan, costing $8.99 a month, allows users to watch on one screen at a given time and allows for the option to download shows or movies. The standard plan, costing $13.99 a month, provides access to two screens at a time and the availability to stream in HD. The most expensive option is the premium plan, costing $17.00 a month and providing access to four screens at a time, while also allowing for streaming in ultra HD.

The need for new subscribers across all services have also brought the IP, or intellectual property, war. Marvel and Star Wars are a few intellectual properties to name that are exclusively owned by Disney, meaning no other services have the rights to use characters affiliated with said IP. With exclusivity being an increasingly imperative factor in generating new subscribers, the idea of original content has also become extremely important, although being very costly. In 2021, Netflix reportedly spent more than $17 billion on content, with $5.2 billion of that being on original content.

With increasing amounts of money being spent on content each year, are these services profitable? Short answer? Yes, but profit is heading in a downward direction. Alongside their loss in subscribers, Netflix announced a profit of $1.6 billion across their first quarter terms, down from the $1.7 billion they made in the first quarter of 2021. Disney is likely following a similar path as they announced earlier this year of adding a lower-priced subscription plan that would be supported with ads.

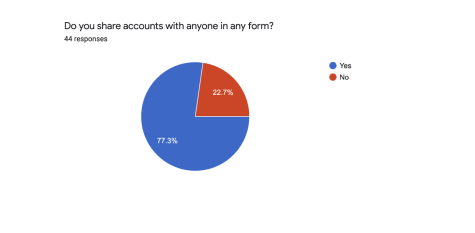

Password sharing however, has become a prevalent issue in maintaining revenue for many services. Netflix estimates that 100 million households are sharing their subscription passwords with other family or friends. Across the board, U.S. video services are expected to lose over $2.3 billion in membership revenue due to password sharing. Netflix, in unsurprising fashion, is expected to see the largest loss, with an estimated reach of about $791 million.

To see the effects of password sharing, 44 students were polled to see if they also shared passwords in any form. Of those 44 responses, 34 students reported that they did share passwords, making up an overwhelming majority.

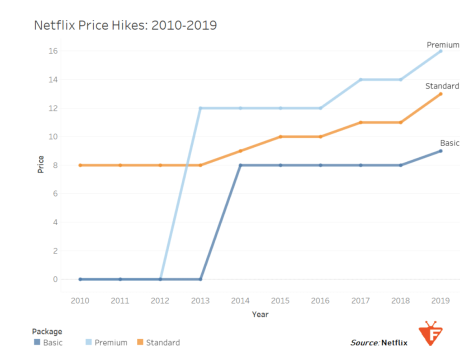

Subscribers are the main method of income for a majority of streaming services, as without monthly subscriptions, these services cannot generate revenue. As a result, dwindling popularity in certain services comes into question. With many services now controlling their own niche in the market, services such as Disney, Netflix, and Amazon Prime alike have raised their prices by at least two more dollars per month. Especially through inflation across the globe and the rampant increase in prices of many services, Momentive, a CNBC subgroup reported that 36% of Americans were considering cutting a monthly subscription. Additionally, Momentive also reported that 35% of people around the country already had cut services to save money. Finance and overall price clearly act as a roadblock to many families, meaning streaming services are becoming a less accessible option to a greater portion of the population.

While the overall number of subscribers in services across the board can certainly grow, the recent oversaturation in market can lead to instances in which Netflix for example, sees an unexpected loss of 200,000 subscribers within their first quarter. The importance of IPs as mentioned before are key in highlighting what makes a certain service unique. Disney’s acquisition of Marvel and Star Wars as an example, highlights the exclusivity in the product that they sell. Disney however isn’t unique in this area. Netflix, HBO Max, Amazon Prime, and even Peacock, NBC’s premiere streaming service, all provide movies and tv shows that are exclusive to their brand. Price yet again plays a factor here. Combining the increase in the amount of streaming services being offered and the tendency for many families to limit themselves in terms of service subscribed to, the spread of subscriber counts are not as concise as they once were. While Netflix was in a market of its own only a few years ago, the sudden increase and rise in competition has spread and redistributed previous Netflix subscribers to other platforms.

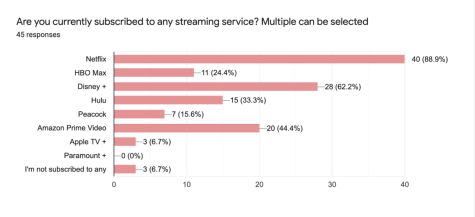

To identify what the distribution of streaming services was like in BCA, a group of 45 students were polled to see which services they were subscribed to. Unsurprisingly, Netflix had the most subscribers, with 40 students stating that they were subscribed. Disney + took second with 28 people stating that they were subscribed, and Amazon Prime Video took third, with 20 students reporting that they were subscribed. In surprising fashion however, only three students declared themselves as not being subscribed to any service. Clearly, streaming services are still popular amongst the student body, as it contradicts the recent downturn in subscriber counts for many services.